If it looks like a duck, quacks like a duck, and walks like a duck, it’s probably a duck.

If it looks like a head-and shoulders pattern …

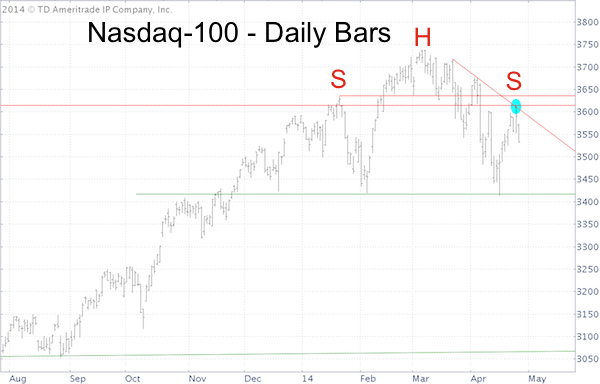

Unlike a duck, a head-and shoulders pattern is never fully confirmed until it’s completed. Nevertheless, the Nadsaq-100 and Nasdaq Composite (Nasdaq: ^IXIC) charts show a near perfect setup for a head-and shoulders top.

The April 20 Profit Radar Report, which featured a forecast for the week ahead, saw the potential for a head-and shoulders pattern when it wrote that: “Up side looks to be limited. The Nasdaq might be carving out a bearish head-and shoulders pattern.”

As the blue oval highlights, yesterday's (Thursday) pop carried the Nasdaq right against double resistance, forming a potential right shoulder.

According to technical analysis rules it will take a drop below the neckline at 3,415 to trigger the actual pattern and down side target, but Thursday's Profit Radar Report published the chart above and noted that: “This is a low-risk setup to go short the Nasdaq-100.”

Continued market forecasts are available via the Profit Radar Report.

Bearish seasonality compounds the potential danger for the Nasdaq and S&P 500. Here's another revealing chart:

Historic S&P 500 Seasonality is About to Turn Ugly

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|