Commercial traders have dropped their silver exposure to the lowest level in years, according to the latest commitment of traders report.

Many commercial traders use futures to hedge existing exposure to silver. The reason many commercial traders have existing exposure is simply because they are ‘in the business’ of mining or buying/selling silver (unfortunately banks also fall into this category).

Many commercial traders could be considered insiders, and thus the ‘smart money.’

Smart investors often follow the smart money.

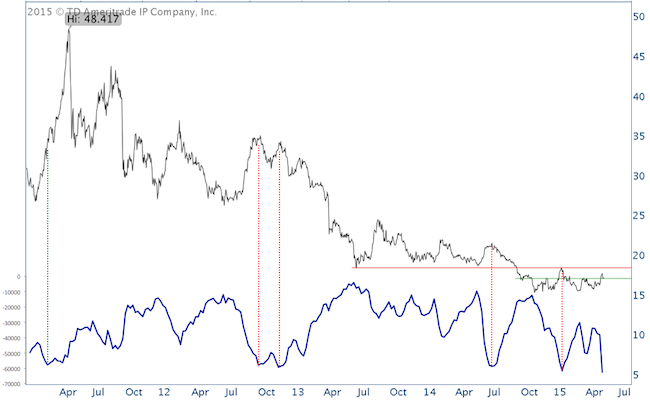

The chart below shows what the smart is money doing.

It was originally published in the May 25 Profit Radar Report, and plots the price of silver against the net short position of commercial traders (hedgers are generally short to hedge their existing long position).

The smart money is holding a record 62,485 contracts, the highest in years.

The dashed red lines show what effect similar short exposure had on silver prices in the past. It wasn’t good.

The last time silver was able to shrug off the same degree of short bets was early 2011, when the silver bull market was alive and well.

If silver can rally despite this extreme, it may be an indication that the bear market is over.

Never Miss a Beat! >> Sign up for the FREE iSPYETF e-Newsletter

However, seasonality suggests lower prices (full silver seasonaliy chart is available to Profit Radar Report subscribers).

Sentiment and seasonality are two major driving forces. Technicals is the third. The short-term chart actually looks constructive, and would allow for higher prices.

However, if trade breaks down, sentiment and seasonality suggest (much?) further down side.

Continued analysis of the three major driving forces (technicals, sentiment & seasonality) for silver and other asset classes is available via the Profit Radar Report.

The iShares Silver Trust (NYSEArca: SLV) is the easiest way to gain silver exposure. The ProShares UltraShort Silver ETF (NYSEArca: ZSL) is one way to bet on lower silver prices.

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013 and 17.59% in 2014.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

Never Miss a Beat! >> Sign up for the FREE iSPYETF e-Newsletter

|