How can you buy a hot ETF without ending up with a hot potato?

Although there’s no foolproof protection (don’t shoot the messenger) against “today it’s hot, tomorrow it’s not” portfolio decisions, there are things that can be done to separate the wheat from the chaff.

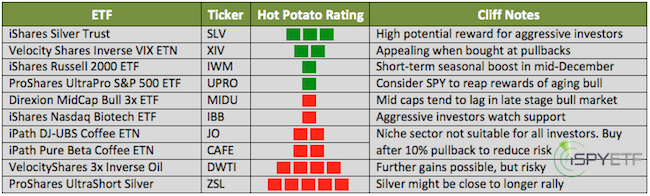

Here’s a look at some of the hottest Exchange Traded Products (ETPs; include ETFs and ETNs) around. The list at the bottom of this article shows which ETPs have the potential to remain (or turn) hot throughout December.

VelocityShares Daily Inverse VIX Short-term ETN (XIV)

This is the best performing non-leveraged ETP over the past three years, up 546.23%. XIV is the inverse counterpart of the popular iPath S&P 500 VIX Futures ETN (NYSEArca: VXX).

Unlike VXX, XIV actually benefits from contango at times of low volatility. Over time this benefit of contango averages about 0.25% per day (click here for an explanation of contango).

VIX seasonality is pointing lower for another few weeks, but things may get a bit rocky for the VIX and XIV thereafter. XIV is a quick mover, but buying XIV at times of significant VIX spikes tends to deliver nice returns.

iShares Russell 2000 ETF (IWM)

IWM is by no means a top performer going into December, however, starting in mid-December, small cap stocks often outperform large cap stocks.

A low-risk strategy to profit from this potential small cap outperformance is this pair trade. Buy IWM and short the S&P 500 ETF (SPY).

Complex Analysis Made Easy - Sign Up for the FREE iSPYETF E-Newsletter

VelocityShares 3x Inverse Crude Oil ETN (DWTI)

DWTI is the hottest ETP over the past four weeks, up 31.53%. Crude oil prices just sliced to the lowest level since May 2010.

Although trade is stretched to the down side, and - like a rubber band - oil may rally at any given time, the crude oil chart does not yet display the classic signs of a major low.

It appears that new lows are still ahead, but milking DWTI at this stage may be a bit greedy. Hey, but there’s nothing wrong with enjoying the trip to the pump for a change.

ProShares UltraShort Silver (ZSL) – iShares Silver Trust (SLV)

The 2x leveraged short silver ETF (ZSL) is up 32.20% over the past three months, but ZSL has ‘hot potato risk’ written all over it.

Silver futures painted a massive green reversal candle on Monday. Now may be the time to trade in ZSL for the iShares Silver Trust (NYSEArca: SLV).

Complex Analysis Made Easy - Sign Up for the FREE iSPYETF E-Newsletter

iShares Nasdaq Biotechnology ETF (IBB)

Biotechnology is the best performing sector year to date, up 31.42%. Investing in biotech is always a bit of a gamble, but the trend for IBB is up as long as support at 300 and 275-280 holds.

Coffee ETFs

A look at coffee prices may explain why your Starbucks venti, half caff, one-pump, skinny, soy latte with extra whipped cream costs more than 5 bugs.

It also explains why two coffee ETPs made it into this year’s list of top 5 hottest non-leveraged ETFs:

-

iPath DJ-UBS Coffee ETN (NYSEArca: JO) +61.34%

-

iPath Pure Beta Coffee ETN (CAFE) +56.84%

Will JO and CAFE continue to caffeinate portfolios or is there risk of a sugar crash? A combination of chart analysis and cycles suggests this low-risk strategy: Buy JO and/or CAFE on a 10% pullback.

‘Big Picture’ ETFs

Drum roll please! Here are the top three ETFs of the past 5 years:

-

ProShares Ultra Consumer Services ETF (NYSEArca: UCC) +493.70%

-

Direxion Daily MidCap Bull 3x ETF (NYSEArca: MIDU) +458.23%

-

ProShares UltraPro S&P 500 ETF (NYSEArca: UPRO) +455.29%

Nine of the top 10 best performing ETFs are leveraged U.S. equity ETFs.

This raises the mother of all 'hot or not' questions: Are U.S. stocks a hot potato? Is this massive bull market (almost) over?

Ask ten different analysts and you’ll probably get ten different answers. When analyzing stocks, I find it best to leave my ego at home and simply look at the facts.

Obviously different analysts look at different facts (many of which are just biases). I like to look at the indicator that correctly foretold the 1987, 2000 and 2007 tops. The same indicator continued to point higher from 2009 until today (click here for more details on this indicator I call 'secret sauce').

In a nutshell, the stock market is showing signs of aging, but a major S&P 500 or Dow Jones top appears still months away. There’s still time to hold some potatoes before they get too hot. However, most investors should consider using non-leveraged vehicles like the S&P 500 SPDR (NYSEArca: SPY) and Dow Jones Diamond (NYSEArca: DIA).

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|