‘Negative compounding’ is how Warren Buffett described the process of paying ever increasing dividends, interest (and rent) to the world outside of the U.S.

Buffett explains his concern with this analogy: The United States has been behaving like a rich family that possesses an immense farm. Not wanting to work, they sell pieces of the farm and increase the mortgage. They improve their cash flow by depleting their assets.

In particular, from the mid-1990s onward Americans consumed far more than they produced, financing the deficit via cheap credit facilitated by the dollar’s world reserve currency status.

By default, this economical and societal shift invites international investors. American sellers are eager to sell and global investors are ready to buy.

Foreigners are able to own a ‘piece of America’ one of two ways:

- Buy U.S. government debt

- Buy U.S. assets

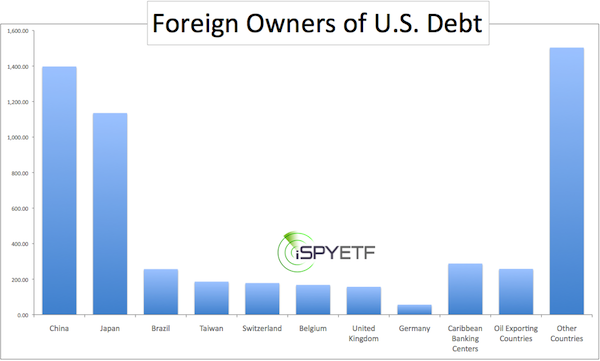

Who Owns U. S. Government Debt?

The chart below provides a quick visual of U.S. debt holders. China and Japan own about $2.5 trillion of U.S. Treasuries, from short-term bonds (NYSEArca: SHY) to long-term Treasury Bonds (NYSEArca: TLT).

Foreign governments and investors own about $5.7 trillion of U.S. debt.

The biggest holder of U.S. debt is actually the Social Security Trust Fund and Federal Disability Insurance Trust Fund (about $2.8 trillion). Other government agencies own another $2 trillion.

The Federal Reserve holds about $1.8 trillion of Treasuries. The remaining $4.7 trillion are owned by mutual funds, pension funds, insurance companies and investors.

The United States Treasury debt amounts to about $17 trillion.

Every country needs investors to finance its operations like a corporation needs shareholders. Beggars can’t be choosers and the U.S. government is happy to take all the money it gets, including the money of international investors.

But owing money to out-of-country investors has its drawbacks as interest payments leave the country. Essentially wealth is being transferred out of the country, or exported. The export of wealth is not beneficial for a country’s balance sheet and health.

Who Owns U. S. Asset

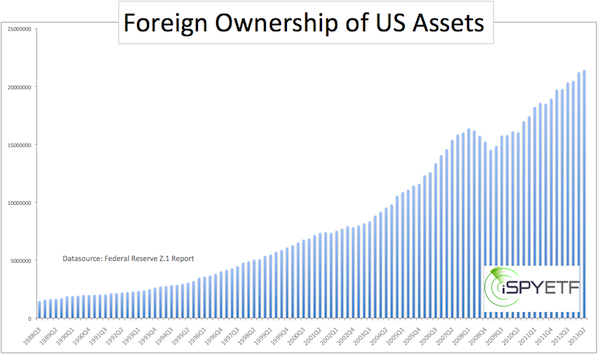

As the chart below shows, foreign ownership of U.S. assets has increased 47.5% to $21.44 trillion since Q1 2009.

The foreign ownership data comes straight from the Federal Reserve’s Z.1 Financial Accounts of the United States report.

Foreign asset ownership (labeled ‘rest of world’ assets in the Z. 1 report) includes financial assets such as deposit accounts, savings accounts, money market accounts and stock holdings such as the SPDR S&P 500 ETF (NYSEArca: SPY), Dow Diamonds (NYSEArca: DIA), Nasdaq (Nasdaq: QQQ) and other funds and individual stocks.

It's important to note that 'rest of world' assets does not include real estate holdings. As international investors continue to buy U.S. real estate, tenants are literally sending their rent checks to landlords overseas.

The export of wealth is significant. Excluding rent payments, the U.S. has transferred somewhere between $550 – 800 billion of interest/income/dividend payments to recipients outside the country.

Based on Buffett’s analogy, American’s are ‘selling the farm’ to finance their spending. The question is how much of the farm is left, or how much is the entire United States worth?

How Much is the United States Worth?

Is it possible to put a price tag on the United States of America? It is, and the article below does just that using asset data from the Federal Reserve. For a detailed analysis on how much the entire United States is worth, click here:

How Much is the Entire United States of America Worth?

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (stocks, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|